What Makes Us Different

We understand the needs of our clients

An exceptional product

AI copilot + IA agents for fraud prevention

Facility of integration

We are building a platform designed for simple integration, with elegant code and excellent API documentation

Local service "hands-on" and client success

Our clients need immediate service and a true strategic partner to resolve complex problems

The three costs related to fraud

Fraud losses

In financial fraud* in Latin America

*Financial fraud = credit and debit card fraud, insurance fraud, identity fraud

Terrible customer experience

Payment acceptance rate in Latin America vs. 80% in the US

Fraud generates a loss in revenue

Costly tools and equipment

Existing tools are expensive and do not cover all use cases because they are built for the US/Europe

Fraud prevention equipment is large and manually performs significant work

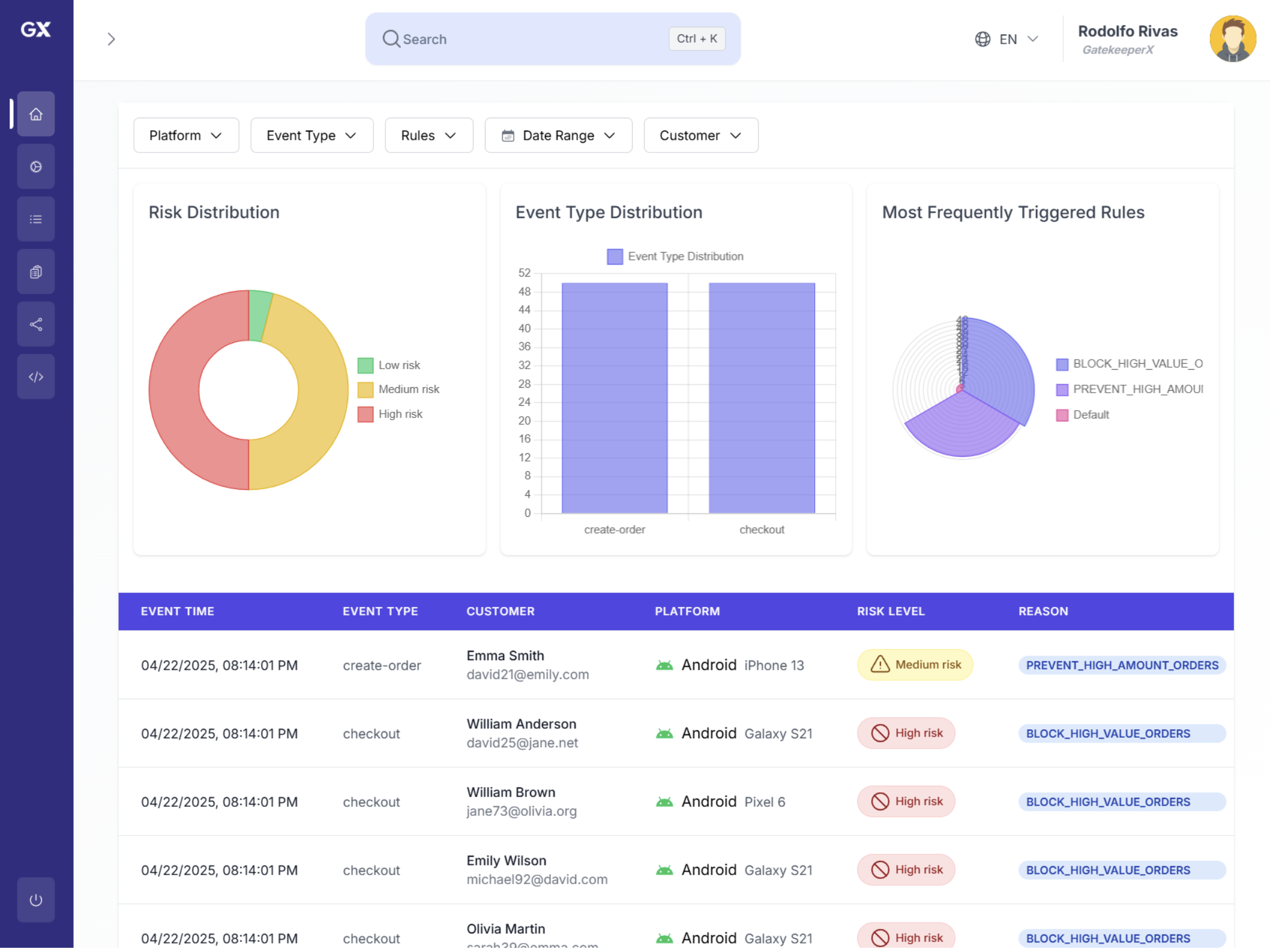

Advanced Tools for Risk Management

Our solutions are designed to optimize your security processes and fraud prevention.

GATEKEEPER

PLATFORM

features

Custom ML scoring models

We train and deploy tailored models to score transactions or users in different use cases

AI-powered anomaly monitor and smart lists

Detect behavioral or transactional anomalies and outliers in real time. Our AI agent detects changes in normal behavior and acts proactively.

Entity graphs

Visualize linkages between users, devices, cards, addresses, etc. to catch fraud rings.

Risk feature Store embedded

Purpose-built features for fraud detection—real-time, historical, and contextual. Customers can create their own data features immediately to react faster to threats.

Tenant-isolated infrastructure

Each customer gets their own dedicated environment for maximum security. Information on bad actors is shared across clients to enrich the network.

AI-powered self-service rule flow engine

SQL-like decision language for custom rules and transparent evaluations. Don't know SQL? Our AI copilot programs rules on behalf of analysts and makes recommendations.

Built by engineers, for engineers

We love beautiful code, clean documentation, easy integrations and overall we care about delivering value. We support our customers with the best post-sales service.

GATEKEEPER

PLATFORM

features

AI-powered self-service rule flow engine

SQL-like decision language for custom rules and transparent evaluations. Don't know SQL? Our AI copilot programs rules on behalf of analysts and makes recommendations.

Risk feature Store embedded

Purpose-built features for fraud detection—real-time, historical, and contextual. Customers can create their own data features immediately to react faster to threats.

Custom ML scoring models

We train and deploy tailored models to score transactions or users in different use cases

AI-powered anomaly monitor and smart lists

Detect behavioral or transactional anomalies and outliers in real time. Our AI agent detects changes in normal behavior and acts proactively.

Entity graphs

Visualize linkages between users, devices, cards, addresses, etc. to catch fraud rings.

Tenant-isolated infrastructure

Each customer gets their own dedicated environment for maximum security. Information on bad actors is shared across clients to enrich the network.

Built by engineers, for engineers

We love beautiful code, clean documentation, easy integrations and overall we care about delivering value. We support our customers with the best post-sales service.

Many types of fraud, multiple tools required and much manual work

Identity Theft and Account Takeover

Illegal access to accounts using personal data, with losses exceeding $50 billion annually.

Payment Fraud

Use of stolen cards or fraudulent payments causing losses of more than $32 billion annually.

Synthetic Fraud

Creation of fake identities to commit financial crimes, generating more than $6 billion in losses.

Money Laundering

Ocultamiento del origen del dinero ilícito, moviendo entre $800 million and $2 billion annually.

Loans and Credit

Obtaining credit with fake documents or identities, affecting banks and credit policies.

E-commerce and Digital Platforms

Frauds with fake products or illegitimate refunds, causing more than $20 billion in losses.